Your business may be eligible to receive the Employee Retention Credit. Here’s what you need to know.

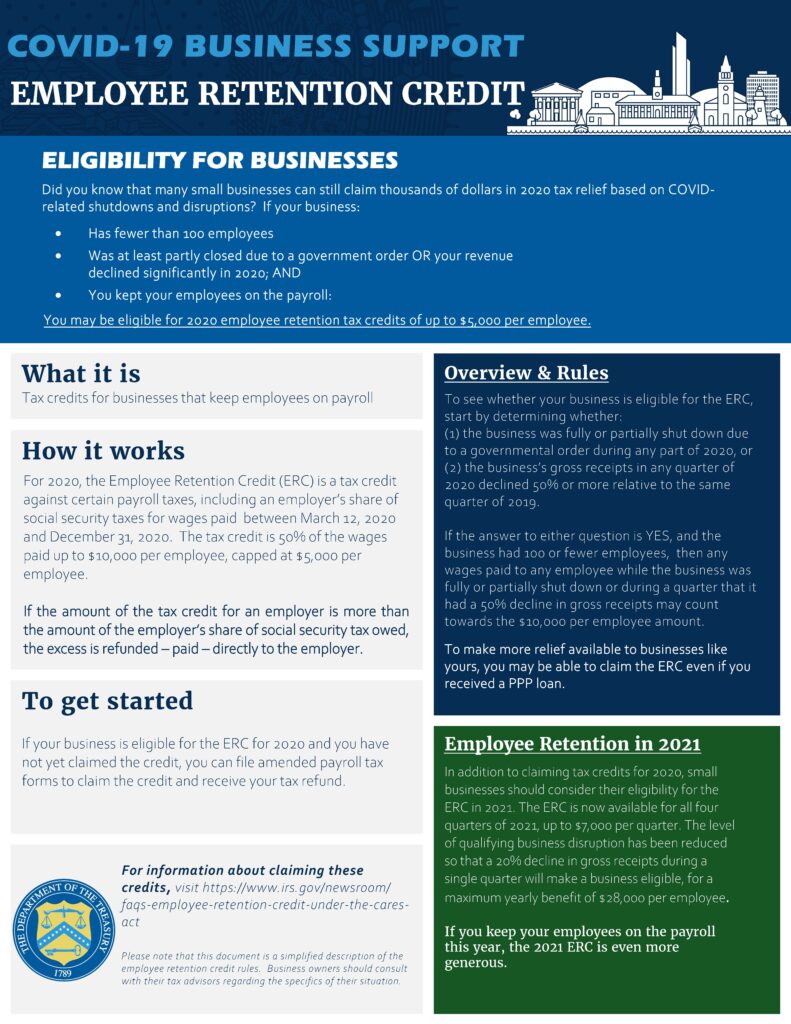

As a part of COVID-19 business support, many small businesses are still eligible to claim thousands of dollars in 2020 tax relief as a result of COVID related business shutdowns and disruptions. If you can answer yes to all the required, below criteria, there may be up to $7,000 in tax credits per employee available to you!

- Has fewer than 100 employees

- was at least partly closed due to a government order OR your revenue declined significantly in 2020; AND

- You kept your employees on the payroll.

In 2020, the Employee Retention Credit (ERC) was a tax credit against applicable payroll taxes paid during the time period of March 12, 2020 through December 31, 2020. This ERC is 50% of your employees wages with a cap at $5,000 per employee. The ERC tax credit program has continued into 2021 with an even more generous offering to aid in keeping your employees on payroll. For the year of 2021, all four quarters included, ERC is capped at $7,000 per quarter rather than $5,000 the previous year. Small businesses who have a 20% decline in gross receipts are now eligible for a maximum yearly tax credit of $28,000 per employee. Even if your company received a Paycheck Protection Program (PPP) loan, you may still be eligible to claim ERC.

At Anfinson Thompson, we believe in helping people understand. As new tax credits are available, we are here to help educate you on how these can best benefit you. Do you think your business is eligible for the Employee Retention Credit? Contact us today to get started on claiming these credits.

Information for this news release was gathered and provided from the Department of the Treasury and IRS Employee Retention Credit resources.