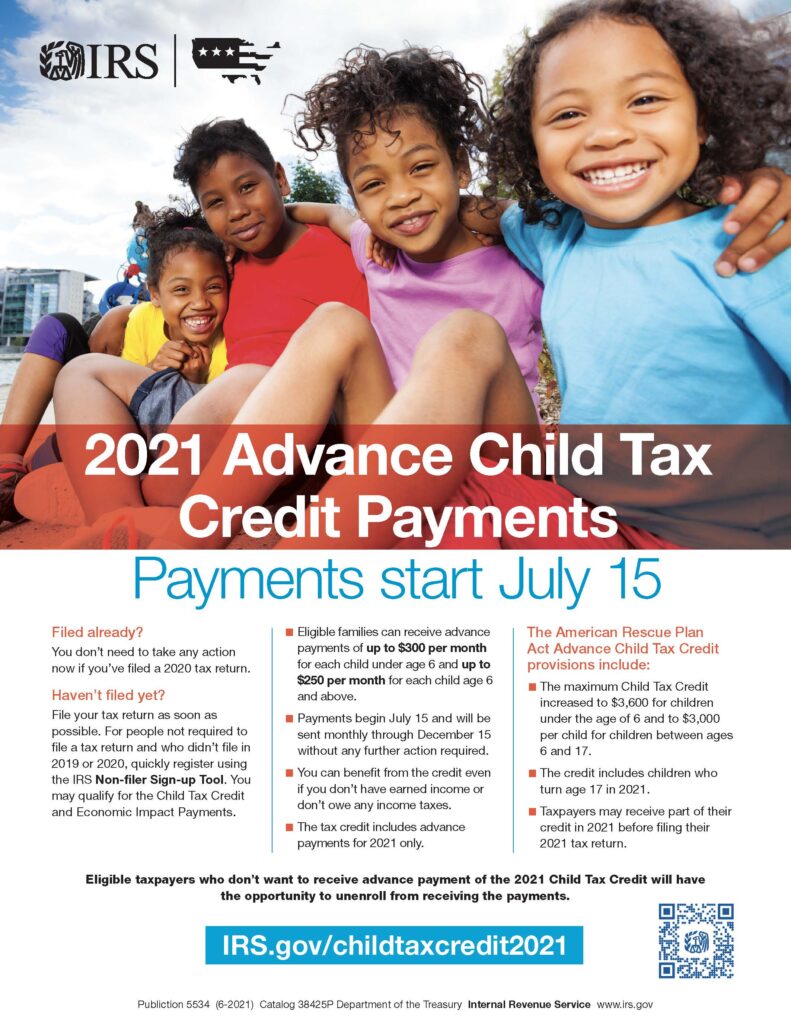

As a result of the American Rescue Plan Act (AARP) going into effect on March 11, 2021, there are advance Child Tax Credit (CTC) payments and increased availability for the 2021 tax year. Families with children under 6 years of age will receive up to $3,600 and $3,000 per qualifying children between 6 and 17 years of age. These tax credits are increased compared to the prior amounts for children. Amounts will be decreased for families with incomes over $150,000 for married taxpayers filing joint and qualifying widow or widowers, $112,5000 for heads of households and $75,000 for all other taxpayers.

Expanded Credit Explanations

- Increased credit amounts for many taxpayers

- Fully refundable credit for qualifying children

- Children who turn 17 years old in 2021 are included

- Taxpayers can receive up to 50% of their Child Tax Credit prior to filing their 2021 tax return.

Advance payments to families will be dispersed, up to 50% of the Child Tax Credit, starting July 2021 through December 2021 to eligible taxpayers. These payments will be based on your 2020 tax returns (or 2019 if 2020 returns are not filed).

Your Next Steps for the Advance Child Tax Credit

- If you would like to receive your advance payments in 2021, no further action is needed. Your first advance payment is anticipated to be issued on July 15, 2021. Unless you have not filed your 2020 return, this will need to be done soon to ensure your early payments.

- If you would like to opt out of your advance payments, you can identify this by using the IRS online portal system. The IRS Child Tax Credit Update Portal will allow you to unenroll from the advance payments and receive your child tax credit in 2022 after your 2021 tax return is filed.

Frequently Asked Questions About Child Tax Credit and Advance CTC Payments

The IRS is providing additional information on how the advance child tax credit will look for eligible families in 2021. For information on when the advanced payments will begin, how payments are received and more check out the IRS guide for advance payment process of the child tax credit.

Information regarding changes to the Child Tax Credit are ongoing, we will continue to educate our clients as more information from the IRS is announced. We believe in educating our clients to aid in making these processes as smooth as possible. If you have additional questions on how this could impact you, contact us today.

For additional information on the American Rescue Plan Act, check out our sister company, Vinna Human Resources.