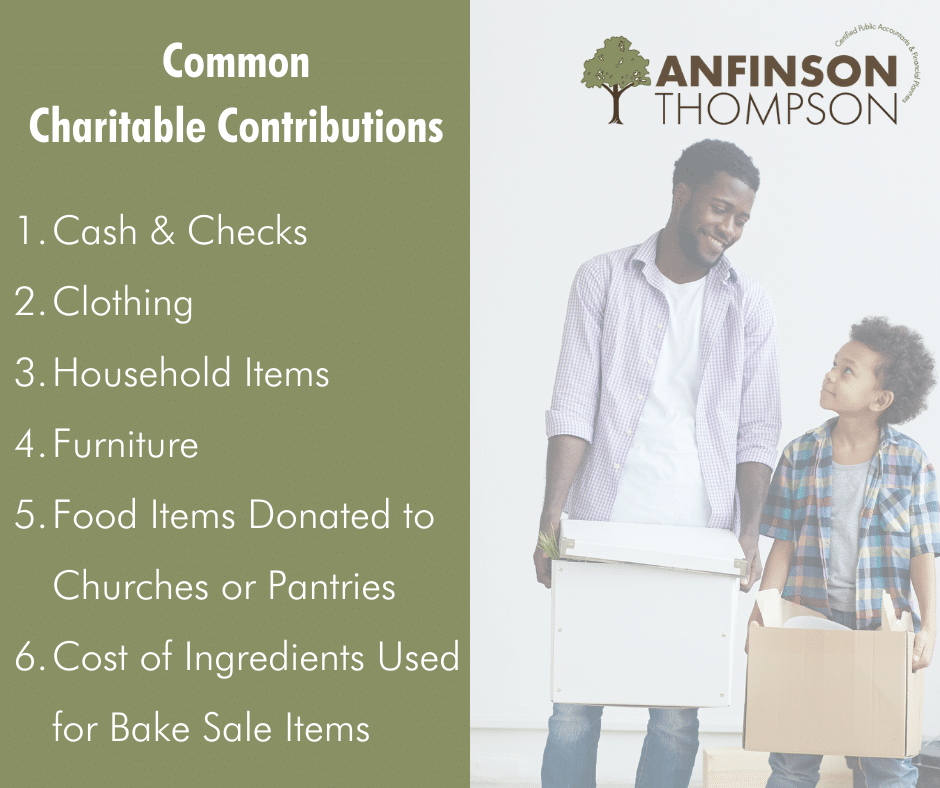

Charitable contributions are not all created equal. Have you donated to a cause in the past and found that during the next year’s taxes the donation was in fact it was not tax deductible. National Association of Tax Professionals (NATP) have provided some deeper details into how to determine which charitable contributions can be used as tax deductions.

Charitable Donation Tax Deduction Limitations

There are several limitations that may apply to charitable contributions, but a dollar-for-dollar reduction in taxable income is available. Contributions are limited to 60% of income if they are made to churches, educational organizations, hospitals, and other nonprofit organizations in the United States. Contributions are limited to 30% of income if made to veterans’ organizations, some domestic fraternal organizations, non profit cemeteries, and certain private foundations. Special rules apply when donating things that would result in capital gain when sold. These include stock, real estate, and other capital assets.

Keep Record of Charitable Contributions

It is important to keep records of contributions stating the amounts and the types of charitable contributions. There are several nondeductible contributions. A few examples are:

- Clothing or food given directly to victims of a disaster

- Food purchased at a bake sale

- Political contributions

- Childcare costs incurred because of volunteer work

- Appraisal fees paid to determine the value of a donated property

- Donations made to secure college sports season tickets

Are you looking to donate to a charity and what to see how if it is deductible from your next year’s taxes? Contact us today and we will navigate you through your charity questions.