Our experienced team understands that supporting the relationships of those who work and volunteer time for their place of worship is a crucial piece of what creates thriving organizations. The need to have a team to help address questions, create solutions and encourage conversation, all while ensuring that the day to day tax and employment goals are met are why leaders of all faiths turn to us. There are special tax rules and tips to keep in mind for clergy clients.

When qualifying as a “minister of the gospel” under federal tax laws there are special tax rules.

- Ministers are exempt from certain withholding requirements

- They may be exempt from social security and medicare coverage

- Most ministers pay self-employment (SE) tax, unless an exemption applies

- They are eligible for a tax-free housing allowance

Ministers are considered an employee for income tax reporting and self-employed when it comes to social security tax reporting. Besides regular wages, there are other funds that may be subjected to income tax. These include:

- Gifts, bonuses or trips paid or provided by the church

- Reimbursements of a spouse’s travel expenses

- Personal use of church-provided vehicles

- Cost of group-term life insurance in excess of $50,000 face value

- Payment by the church of personal expenses

- Premiums for permanent life insurance if you can select the beneficiary

- Church contributions to a traditional IRA of Roth IRA

- Prizes/awards received as part of you ministerial work, other that those for the length of service

- Tuition payments for your spouse or children

- Amounts the church pays toward your income tax or self-employment tax, other that through withholding from your salary

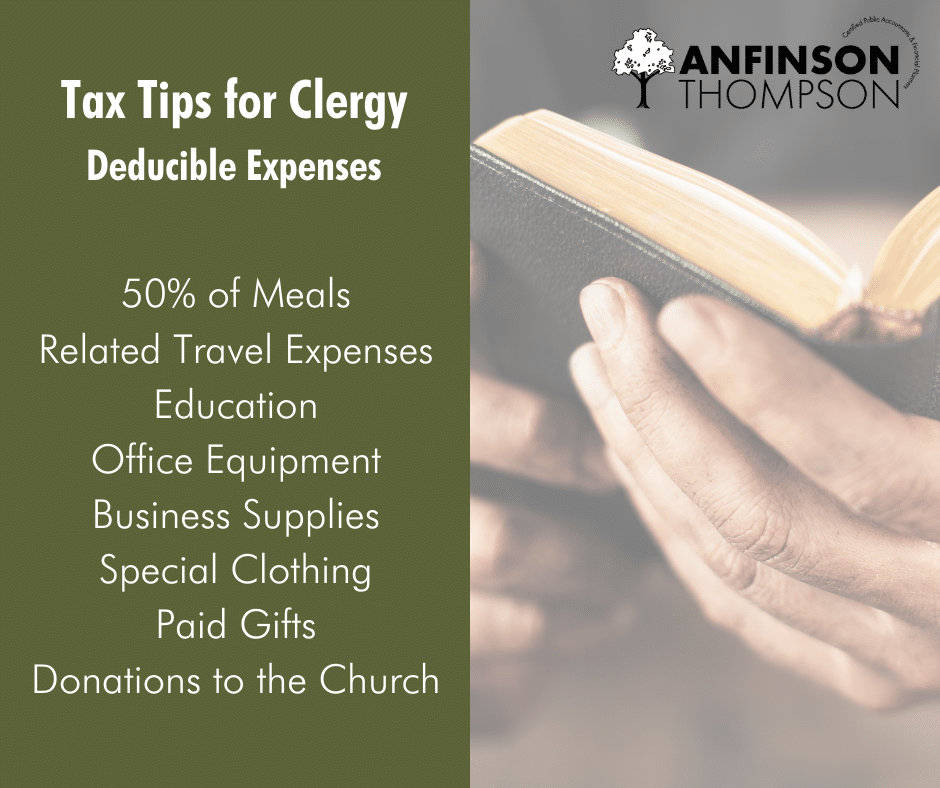

The following expenses may be deductible:

- 50% of meal expenses

- Travel expenses for attending church function

- Educational expenses

- Office equipment

- Vestments

- Long distance work calls

- Gifts made

- Contributions to the church

Home rental allowance may be excluded from income tax, but the amount excluded can’t be more than the fair rental value of the home. All net earnings are subject to self-employment tax.

Reach out to us today to discuss your individual deductible expenses.

Information from this post was gathered from the National Association of Tax Professionals.