We have years of experience designing specific strategies for clients to follow throughout the year to reduce taxes while understanding the impact of the latest tax laws, legislation and IRS rules. Each industry is unique and has its own regulations to follow. This week we focus on our daycare provider tax tips.

When starting a daycare business it is important to check the states requirements for licensing. Whether you decide to operate as a sole proprietor or partnership the IRS requires payment of self-employment tax on income. If the daycare is operated as a corporation then you are considered an employee of the corporation and should receive a reasonable wage. Fees received from the county to assist low-income families are also generally taxable. Once your daycare has employees the IRS requires an Employer Identification Number (EIN).

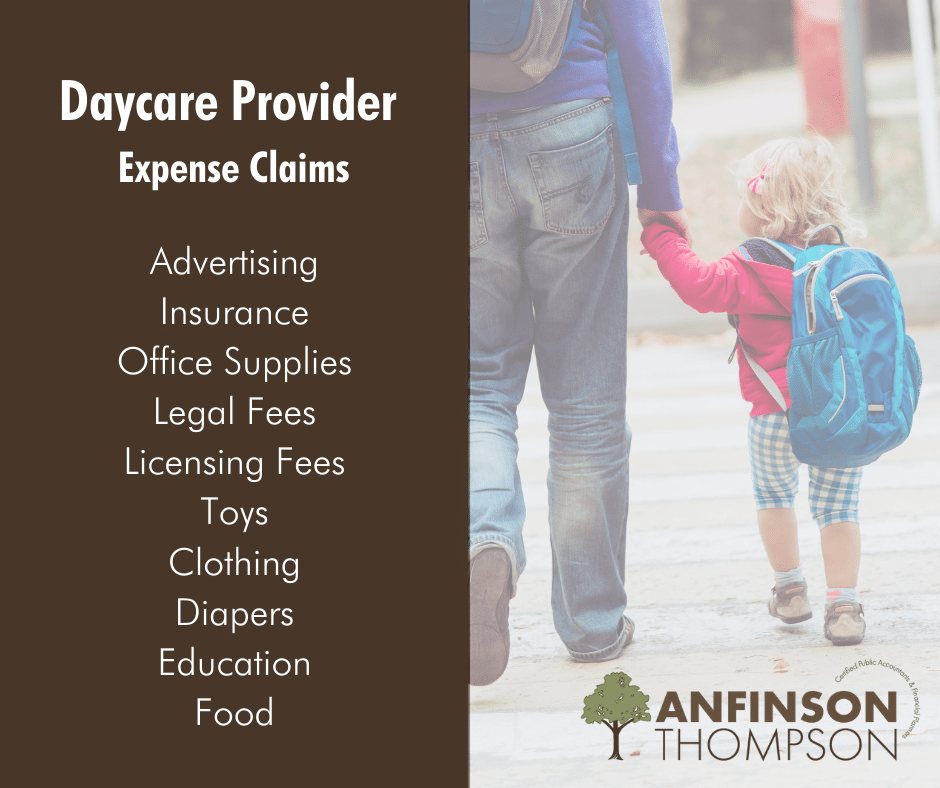

There are several different expenses that relate to a daycare business that can be deducted. Some common deductible expenses are:

- Advertising

- Insurance

- Office supplies

- Legal and professional fees

- Licensing or registration fees

- Toys

- Clothing

- Diapers

- Automobile expenses

- Education and training expenses to improve and maintain skills

- Special equipment

- Food

Daycare providers that work out of their home may be able to deduct expenses that relate to the use of the home. The general requirements are you must be in the trade or business of providing daycare for children, persons age 65+ or persons who are physically or mentally unable to care for themselves, and have applied for, been granted, or been exempt from having a license, certification, registration, or approval as a daycare center.

At Anfinson Thompson, we serve small to mid-size businesses. Contact us today to design strategies you can follow throughout the year to reduce your taxes while understanding the impact of the latest tax laws, legislation and IRS rules.